Komatsu Ltd. (“Company”) (President and CEO: Hiroyuki Ogawa) and its consolidated subsidiaries (together “Komatsu”) have revised the projections for consolidated business results as well as cash dividend for the fiscal year ending March 31, 2021 (April 1, 2020 - March 31, 2021), which Komatsu announced on July 30, 2020.

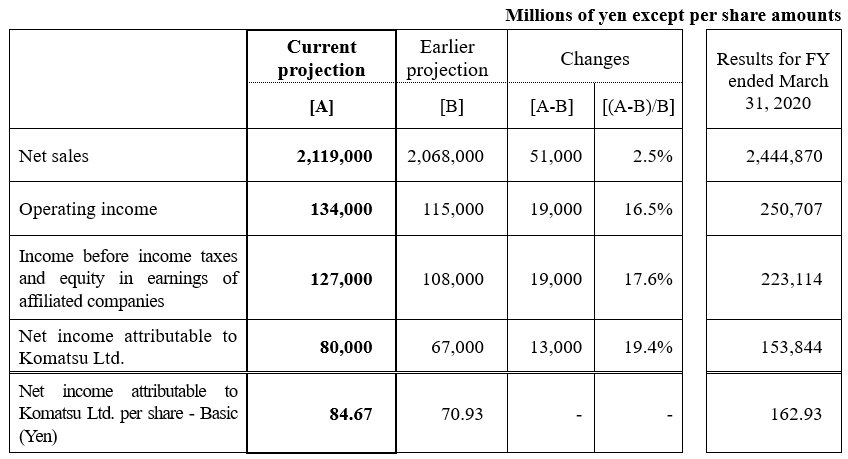

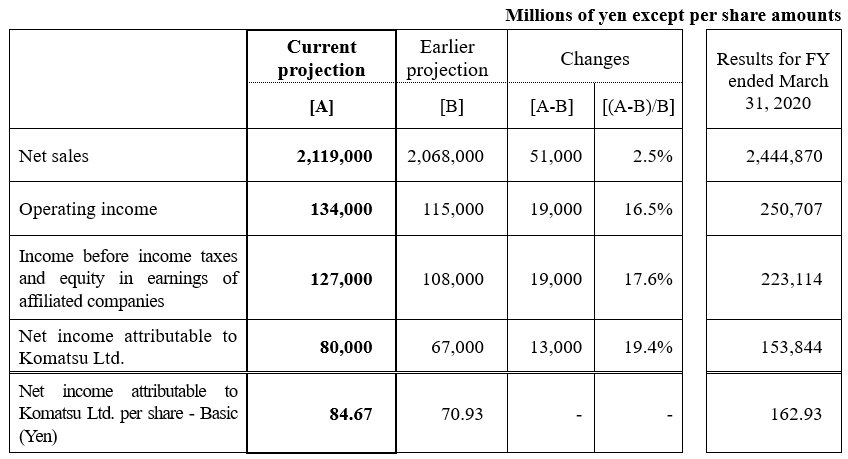

1.Projection for Consolidated Business Results for the Fiscal Year Ending March 31, 2021 (U.S. GAAP)

Reasons for the Revision

In the first six-month period (April 1 - September 30, 2020) of the fiscal year ending March 31, 2021, demand for construction and mining equipment decline, particularly in North America, Europe & CIS, and Asia as affected by the coronavirus (COVID-19) pandemic. In the second six-month period (October 1, 2020 - March 31, 2021), Komatsu assumes that demand will remain steady in China and will get back on a recovery track in North America, Japan and some other regions. While Komatsu will continue to invest in growth areas, an effort of focus in the mid-term management plan, it can also look forward to benefits of reduced fixed costs by having reassessed the priorities of projects and improved operational efficiency. As a result, we can expect that full year business results for FY2020 will outperform the projections as of July 30, 2020 and we will revise both sales and profits.

Concerning foreign exchange rates, which are preconditions for the projection of full year results, Komatsu has revised the projected exchange rate with the euro (to EUR 1=JPY 124 as the average exchange rate in the second six-month period). Accordingly, Komatsu estimates the average exchange rates for the full year as follows: USD 1=JPY 106.1, EUR 1=JPY 122.7 and RMB 1=JPY 15.1. (Initial assumption: USD 1=JPY 105.6, EUR 1=JPY 116.7 and RMB 1=JPY 15.0)

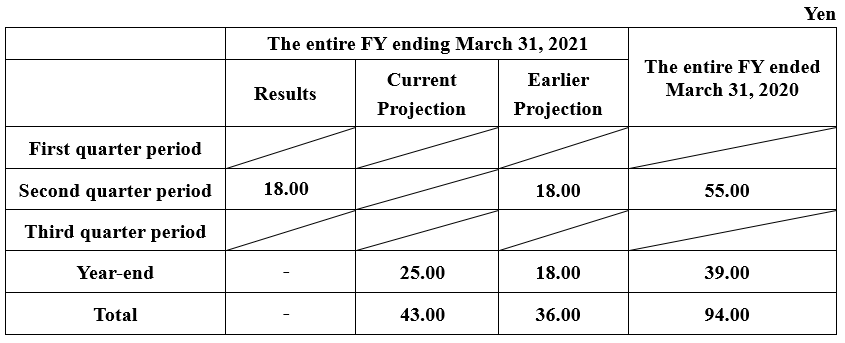

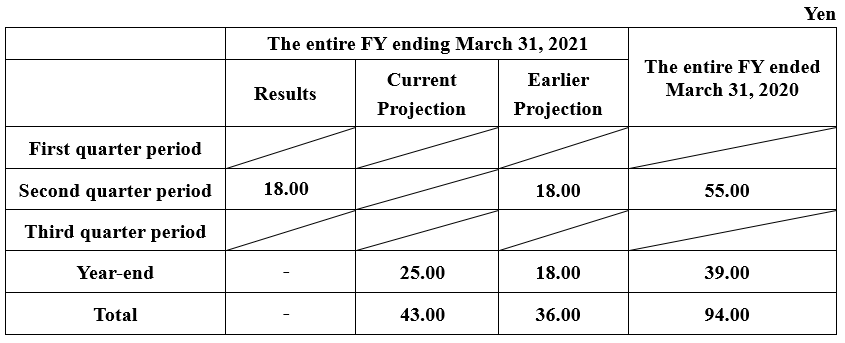

2.Revision of Projected Cash Dividend

Reasons for the Revision

Komatsu is building a sound financial position and is enhancing its competitiveness in order to increase its sustainable corporate value. Concerning cash dividends, Komatsu has the policy of continuing stable payment of dividends after comprehensively considering consolidated business results and reviewing future investment plans, cash flows and the like. Specifically, Komatsu has the policy of maintaining a consolidated payout ratio of 40% or higher.

Concerning the interim cash dividend under this basic policy, Komatsu is planning to set JPY 18 per share, as projected on July 30, 2020. With respect to the year-end cash dividend, after reviewing business results for the first six-month period of FY2020 and considering future business prospects, Komatsu is also revising its earlier projection and planning to increase that dividend by JPY 7 from the projection, to JPY 25 per share. As a result, Komatsu plans to pay annual cash dividends of JPY 43 per share, decrease of JPY 51 from the previous fiscal year ended March 31, 2020. The consolidated payout ratio will become 50.8%, as Komatsu maintains its earlier projection.

Cautionary Statement

The announcement set forth herein contains forward-looking statements which reflect management's current views with respect to certain future events, including expected financial position, operating results, and business strategies. These statements can be identified by the use of terms such as “will,” “believes,” “should,” “projects” and similar terms and expressions that identify future events or expectations. Actual results may differ materially from those projected, and the events and results of such forward-looking assumptions cannot be assured.

Factors that may cause actual results to differ materially from those predicted by such forward-looking statements include, but are not limited to, unanticipated changes in demand for the Company's principal products, owing to changes in the economic conditions in the Company’s principal markets; changes in exchange rates or the impact of increased competition; unanticipated cost or delays encountered in achieving the Company's objectives with respect to globalized product sourcing and new Information Technology tools; uncertainties as to the results of the Company's research and development efforts and its ability to access and protect certain intellectual property rights; and, the impact of regulatory changes and accounting principles and practices.