【Original article of China Road Machinery Network】End of April 2023,The disclosure of annual reports of major listed companies in the construction machinery industry has been completed。According to the annual report,Performance decline has become the main theme of listed companies in China's construction machinery industry in 2022.。2022,Unprecedented Changes in the World in a Century Accelerate Evolution,The domestic economy is suffering“Triple pressure”,Multiple factors lead to more severe industry adjustment than expected.。In the face of shrinking domestic demand,The annual export exceeded 40 billion US dollars.,Reaching 443.$0.2 billion,Year-on-year growth of 30.2%,Effectively hedging the decline in the domestic market。Among the major listed companies,Excluding Shantui Shares in 2022、Anhui Heli、Zhejiang Dingli、Operating income of railway construction heavy industry and other companies、Net profit has achieved good growth.,Other major listed companies have declined.。

Performance Decline, Industry Trapped in Cycle Again

According to the annual report of 2022 disclosed by major listed companies in the industry recently.,Major 13 listed companies in the industry achieved operating income of 3029.4.6 billion yuan,Compared with 3439 in 2021.400 million yuan, down 12.%;Net profit 172.02.Billion yuan, Compared to 299 in 2021.400 million yuan, down 43.%。While the business performance of enterprises is declining,Net profit and asset quality both declined synchronously.,The industry is trapped in the cycle again。

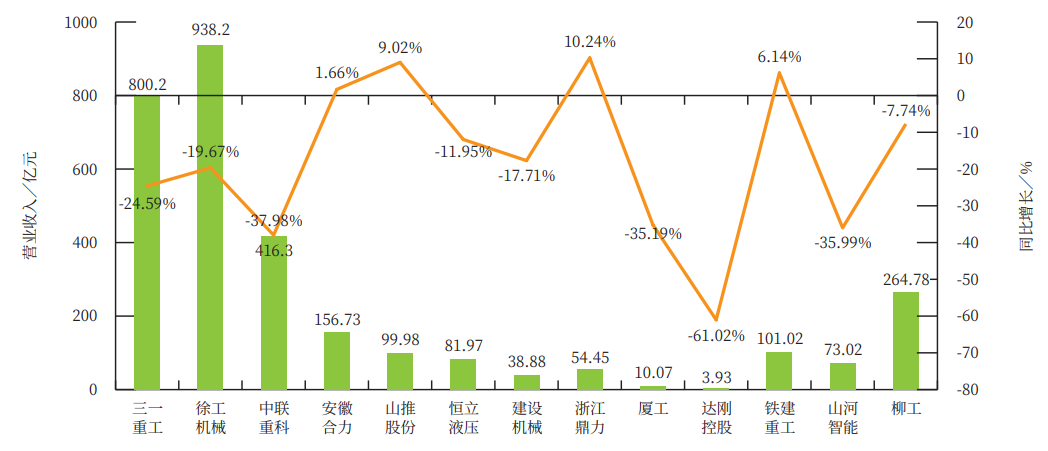

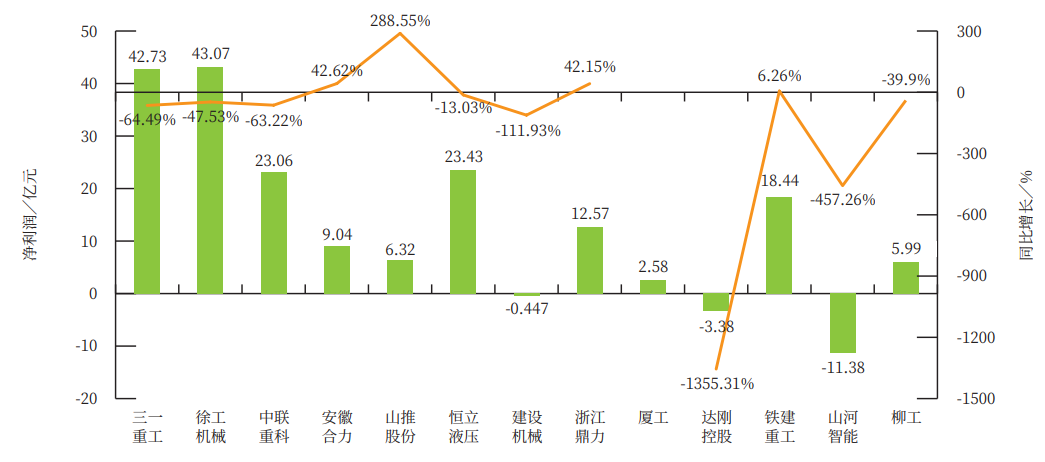

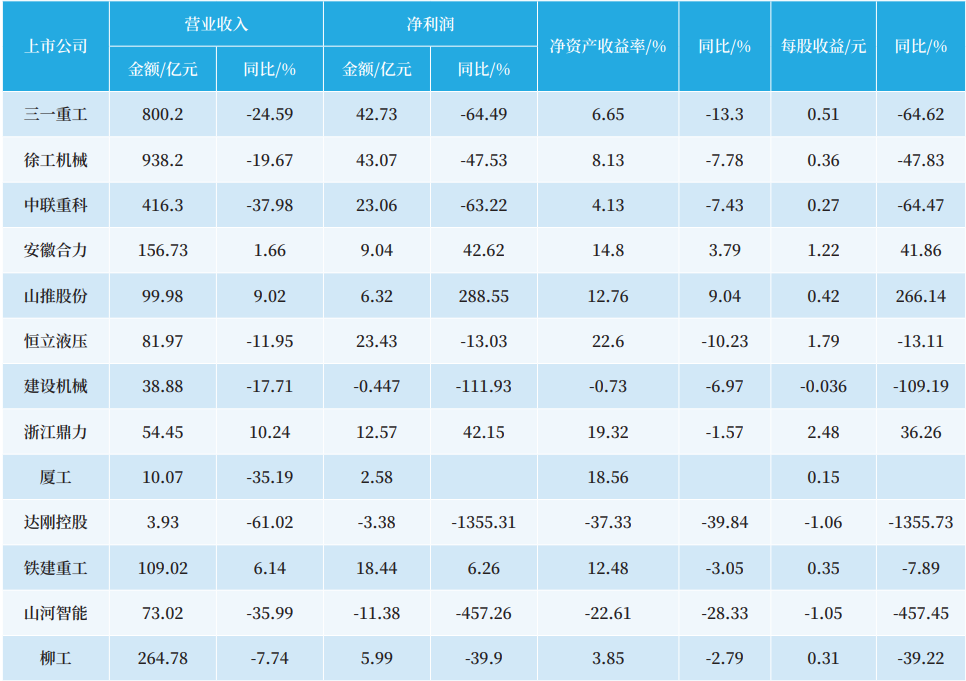

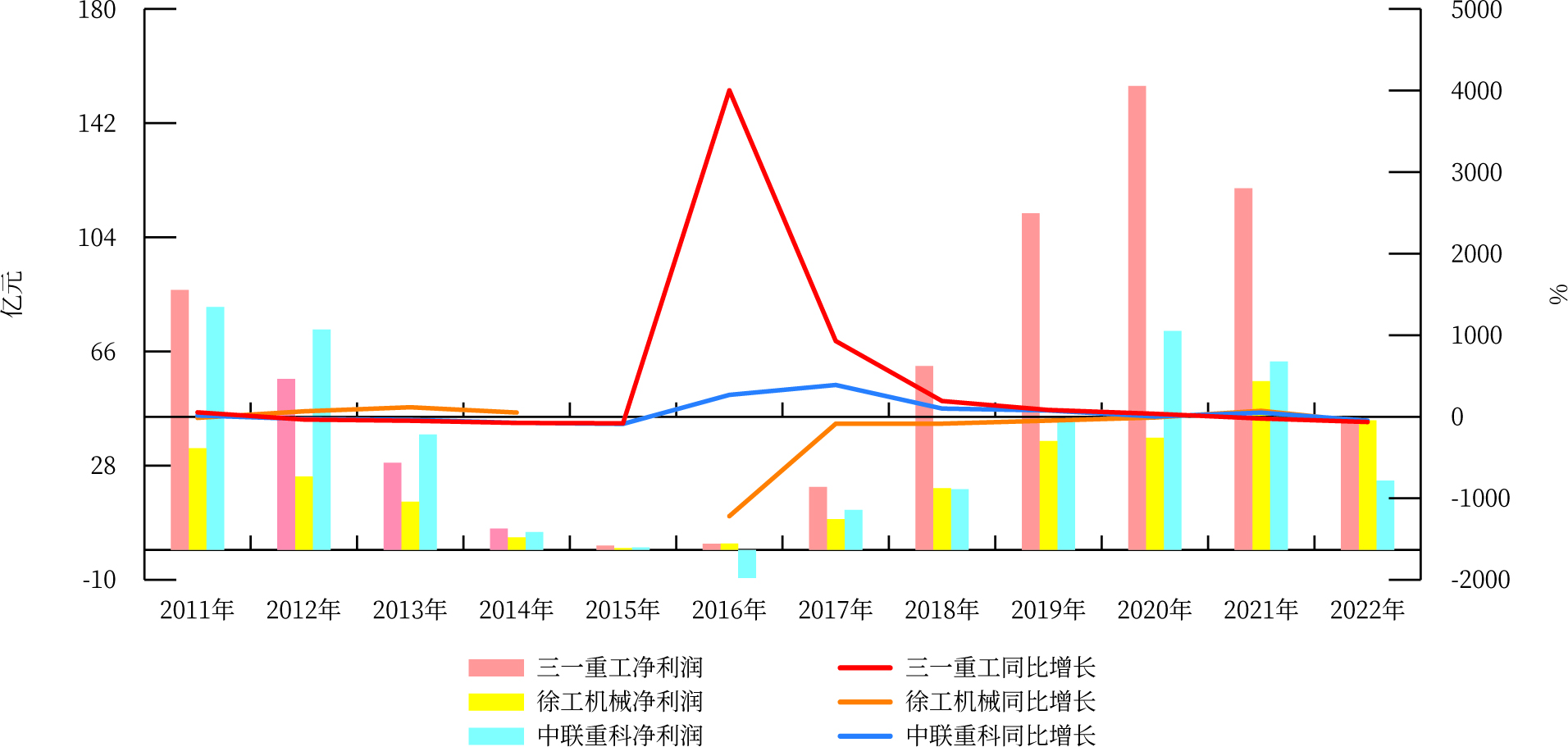

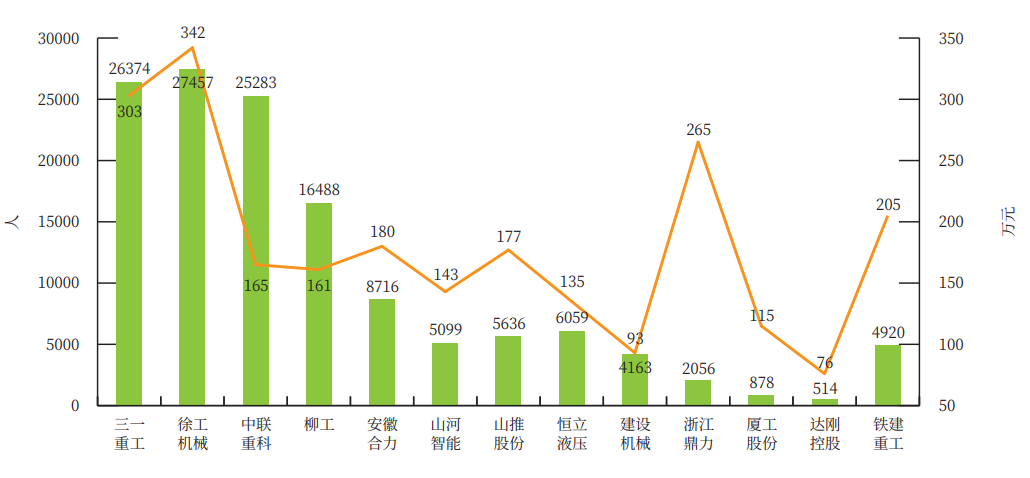

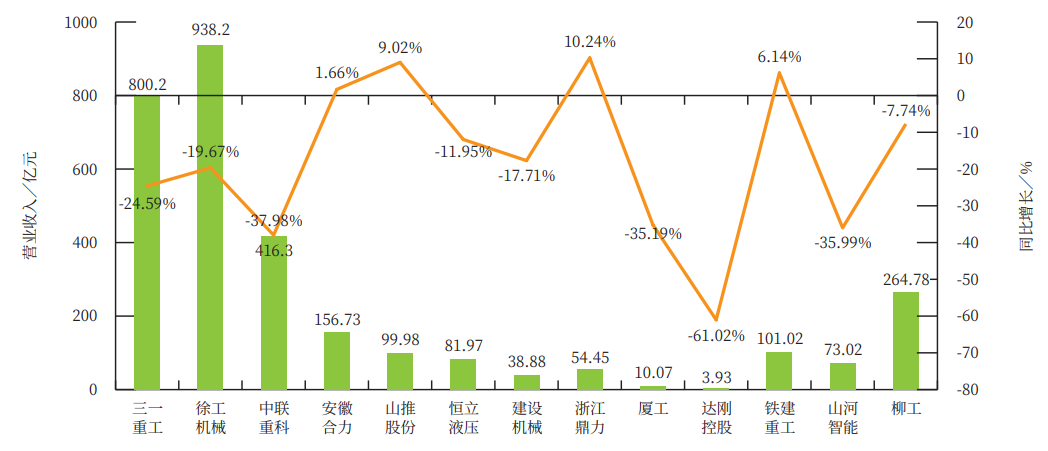

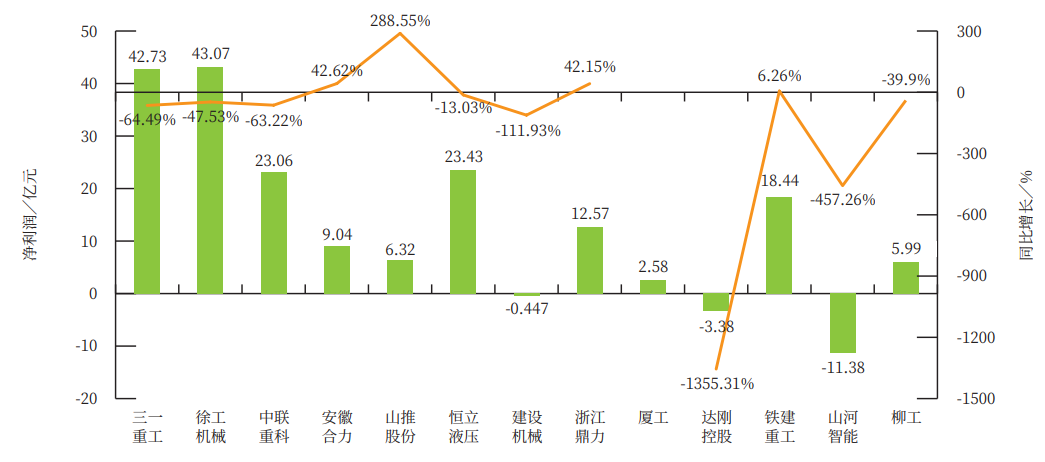

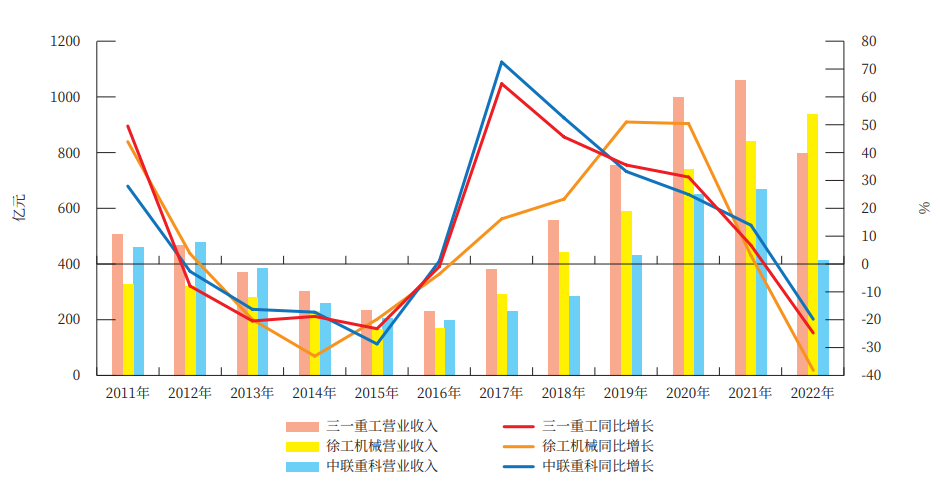

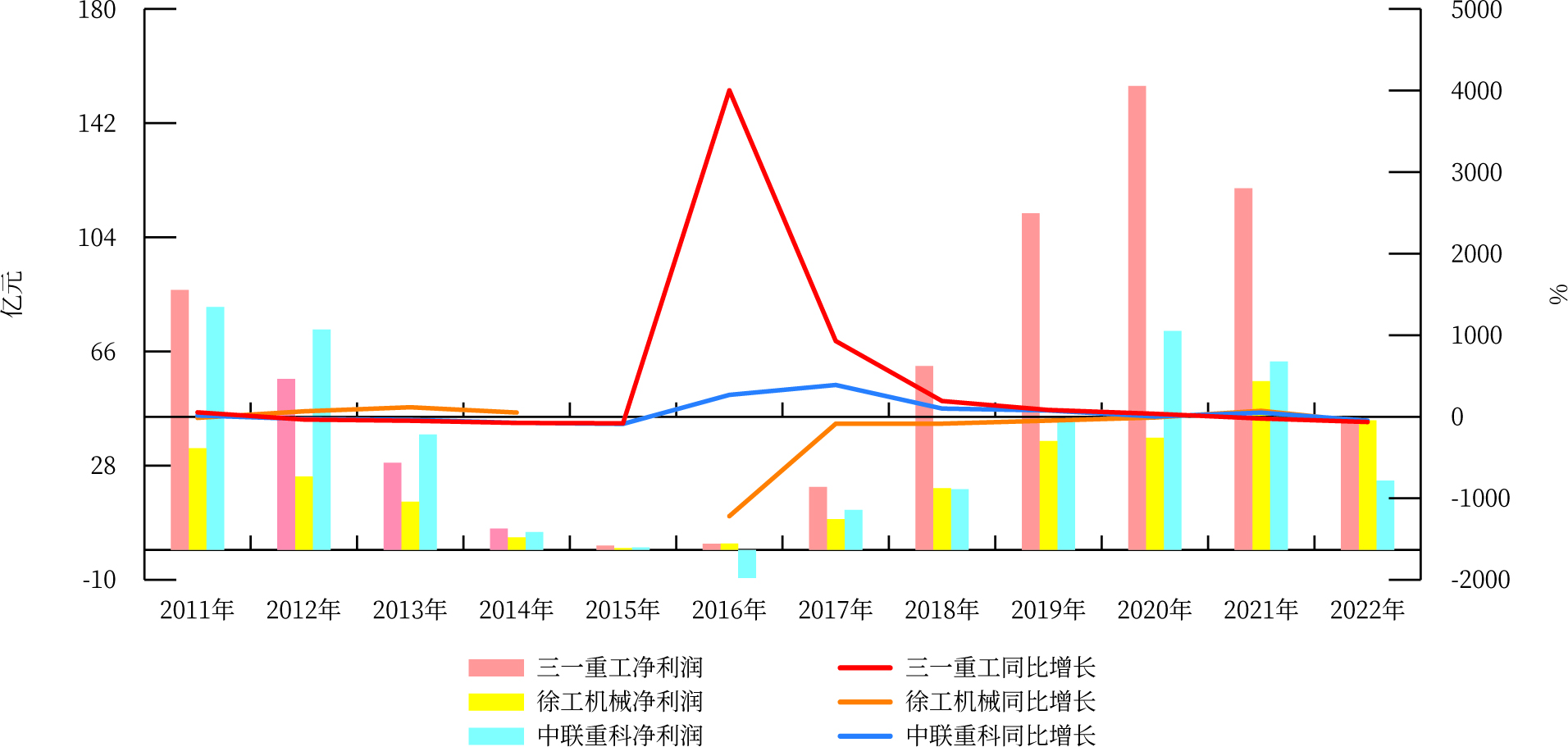

There are 6 companies whose business income exceeds 10 billion yuan.。XCMG 938.200 million yuan,Year-on-year decline of 19.67%;Sany Heavy Industry 800.200 million yuan,Year-on-year decline of 24.59%;Zoomlion 416.300 million yuan,Year-on-year decline of 37.98%;Engineer Liu 264.7.8 billion yuan,Year-on-year decline of 7.74%;Anhui Heli 156.7.3 billion yuan,Year-on-year growth of 1.66%;Railway Construction Heavy Industry 101.0.2 billion yuan,Year-on-year growth of 6.14%。The largest increase in net profit is Shantui shares.,Net profit for the year was 6.3.2 billion yuan,Year-on-year growth of 288.55%。Among,Investment income from disposal of Komatsu Yamatsu and other associates in 2022 3..400 million yuan,Accounting for 48% of the total annual profit.02%。Secondly,Anhui Heli Annual Net Profit 9.0.4 billion yuan,Year-on-year growth of 42.62%;Zhejiang Dingli Annual Net Profit 12.5.7 billion yuan,Year-on-year growth of 42.15%。The largest decline in net profit was Dagang Holdings.,Annual net profit loss 3.3.8 billion yuan,Year-on-year decline of 1355.31%,The substantial loss was due to the full provision for impairment of the remaining goodwill formed by the acquisition of Zhongde Environmental Protection..4.2 billion yuan,Resulting in a sharp year-on-year decline in performance。Secondly, the largest decline in net profit is Sunward Intelligence.,Annual net profit loss 11.3.8 billion,Year-on-year decline of 457.26%。(Figure 1、Figure 2、Shown in Table 1)

Figure 1 Changes in operating income of major listed companies in 2022

Figure 2 Changes in Net Profit of Major Listed Companies in 2022

Table 1 Operating Income and Net Profit of 13 Major Listed Companies in 2022

2022,Listing of XCMG as a whole,Digging machine、Mining Machinery and other high-quality assets into listed companies,Net profit attributable to shareholders of the listed company realized by XCMG is 43.0.7 billion yuan,Operating income and net profit attributable to the parent company rank first in the industry in China.。

The top three are always strong

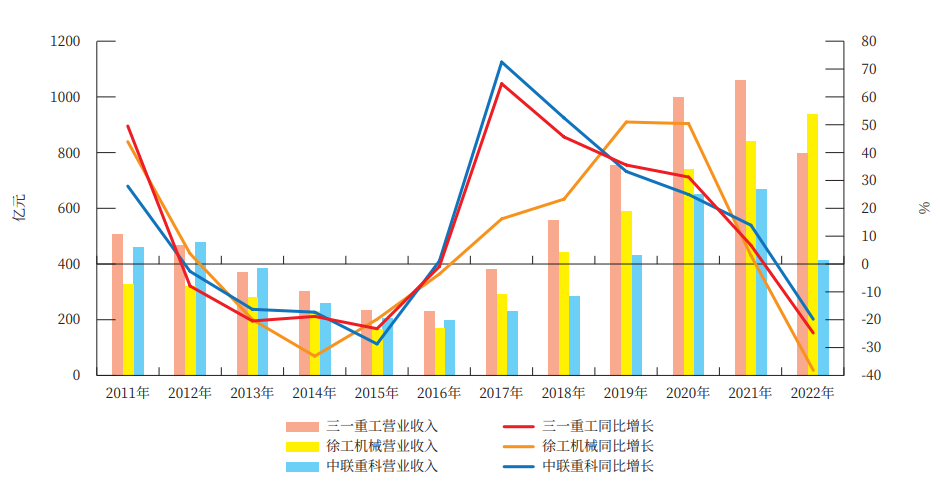

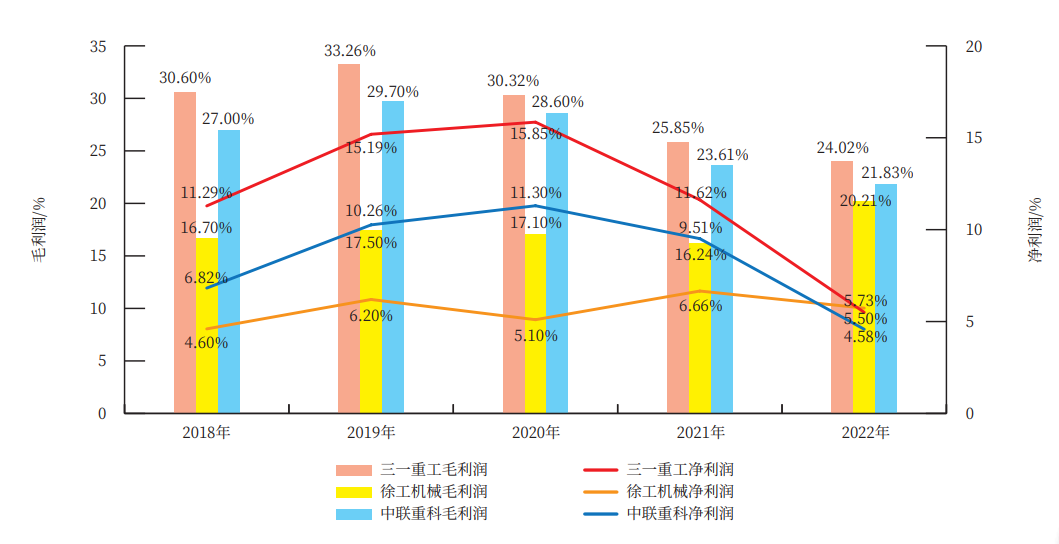

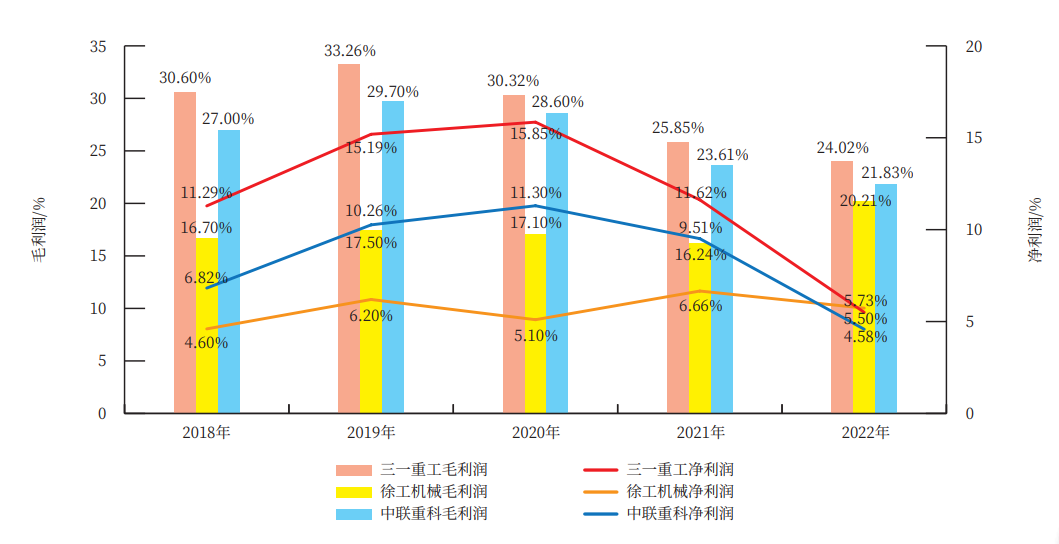

Sany Heavy Industry in 2022、Zoomlion、The three enterprises of Xugong Machinery accounted for 71% of the operating income of 13 listed companies.1%,Up to 2154.700 million yuan,Net profit 108.8.6 billion yuan,Accounting for 63% of the net profit of 13 listed companies.3%。Among,Sany's operating income accounted for 26 percent%,Gross profit margin 24.02%,Year-on-year decline of 1.84%,Net profit 5.5%,Year-on-year decline of 6.11%;XCMG's operating income accounted for 31 percent%,Gross profit margin 20.21%,Year-on-year growth of 3.97%,Net profit 4.58%,Year-on-year decline of 2.12%;Zoomlion's operating income accounted for 14%,Gross profit 21.83%,Year-on-year decline of 1.78%,Net profit 5.73%,Year-on-year decline of 3.78%。Net profit of Sany Heavy Industry accounted for 24.8%,XCMG accounted for 25.04%,Zoomlion accounts for 13.4%。As shown in Figure 3、Figure 4、Shown in Figure 5。

Fig. 3 2011-Changes in business income of the top three in China's construction machinery industry in 2022

Figure 4 2011-Changes in the top three net profits of China's construction machinery industry in 2022

Figure 5 2018-Changes in gross profit rate and net profit rate of the top three in China's construction machinery industry in 2022

2022,Sany Heavy Industry Excavator Achieved Sales Revenue 357.600 million yuan,In the domestic market, it has been the sales champion for 12 consecutive years.,The market share of super-Excavator/ 'target='_blank' style='color:blue;'>Large Excavators rose to the first place.,The gross profit margin of Excavators was 27.9%,Year-on-year decline of 1.04%; Sales revenue of Concrete Machinery 150.800 million yuan,It is the first brand in the world,Gross profit margin 21.77%,Year-on-year decline of 3.22%;Sales revenue of hoisting machinery 126.700 million yuan,Gross profit margin 15.77%,Year-on-year decline of 3.82%,Truck_crane/ 'target='_blank' style='color:blue;'>Truck Crane market share continues to rise to 32%;Sales revenue of Road Machinery 30.800 million yuan。The gross profit margin of the company's products increased from 18% in the fourth quarter of 2021.87%Gradually rising to 22% in the second quarter of 2022.84%、27 in the fourth quarter.26%。The repayment rate in 2022 is 90 percent.4%。

XCMG Concrete Machinery achieved sales revenue of 95.0.2 billion yuan,10%.13%,Gross profit margin 16.34%,Year-on-year decline of 1.19%;Lifting machinery achieved sales revenue 238.600 million yuan,25%.43%,Gross profit margin 19.87%,Year-on-year decline of 1.88%;Earth-moving machinery achieved sales revenue 236.3.9 billion yuan,25%.2%,Gross profit margin 25.32%,Year-on-year decline of 2.05%。Road Machinery export revenue accounted for nearly 50 percent%,Road Roller、Paver、Grader market share ranks first in the industry,Milling Machine occupancy increased by 2.1 percentage point。

Zoomlion Concrete Machinery Revenue 84.600 million yuan,Year-on-year decline of 48.35%,20%.32%,Gross profit margin 21.03%,Year-on-year decline of 3.2%;Lifting machinery 189.7.9 billion yuan,Year-on-year decline of 48%,45%.6%,Gross profit margin 22.91%,Year-on-year decrease of 0.38%;Earth-moving machinery sales revenue 35.1.2 billion yuan,8%.43%,Gross profit margin 23.48%,Year-on-year growth of 4.55%;Sales Revenue of Aerial Work Machines 45.9.6 billion yuan,Year-on-year growth of 37.15%,11%.04%。Among,The sales scale of construction hoisting machinery ranks first in the world.,And launch the ultimateROn behalf of the Tower Crane,Realization“Global security、30 years of life、Remote management”Breakthroughs in three core technologies,Establish the world Tower Crane technology benchmark。

New Energy、Electrification is a great opportunity for the development of construction machinery industry,In 2022, major enterprises in the industry comprehensively promoted the electrification of mainframe products and the development of related core components and technologies, and achieved tangible results.。

2022,The number of electric R & D personnel of Sany Heavy Industry Company has increased from less than 100 in 2021 to more than 1600 now.,The business covers the battery、Electrically controlled、Electric drive、Electronic and electrical、Control algorithms and thermal management.。Comprehensively promote engineering Vehicles、Excavating Machinery、Loading machinery、Electrification of lifting machinery and other products, Focus on pure electricity、Three technical routes of hybrid and hydrogen fuel,Continuous Iteration of Electric Products。By 2022,The company has developed 79 electric products.,Listed 67 electric products。Take the Excavator as an example.,Develop 11 products in 2022,Seven models are listed。2022,Sales of Sany's electric products have exceeded 2.7 billion yuan.,The growth rate is over 200%,More than 3500 units sold。Sales revenue of new energy products of XCMG in 2022 42.700 million yuan,Continuous doubling growth。Sales of Zhejiang Dingli Electric Products accounted for 95.44%,Electric rate of arm-type products up to 62.29%,The shearing electric rate is up to 97.22%,Electric rate of mast-type products up to 100%。

Domestic sales are sluggish,Exports continue to grow at a high rate

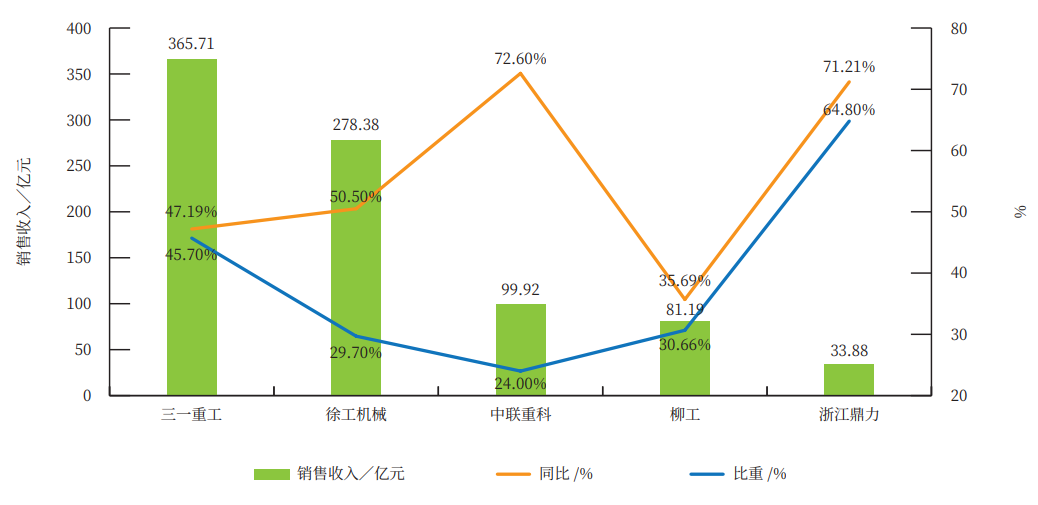

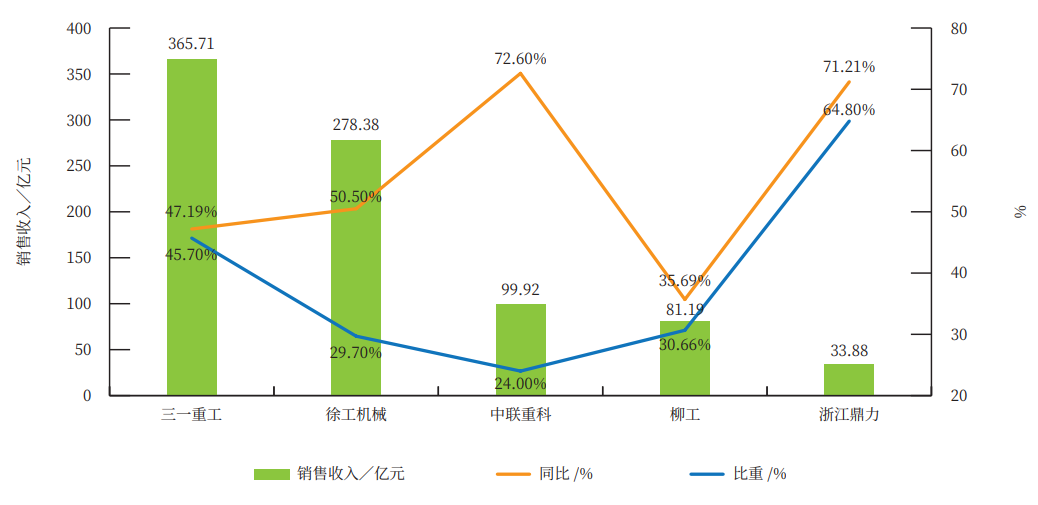

Overseas exports continue to grow at a high speed in 2022,It makes up for the shortage of domestic market demand for construction machinery in China.。In 2022, 13 major listed companies achieved overseas revenue of 1014.8.4 billion yuan,Compared to 587 in 2021.7.1 billion yuan, an increase of 42.7.1.3 billion yuan,Year-on-year growth of 73%,33%.5%。The overseas sales of five construction machinery listed companies including Sany Heavy Industry in 2022 are shown in Figure 6.。

Figure 6 Overseas Sales Revenue of Five Enterprises in 2022

Sany Heavy Industry's Overseas Revenue 365.7.1 billion yuan,Year-on-year growth of 47.19%,Excluding Putzmeister's international sales revenue 301.4.2 billion yuan,Growth 58.5%;Annual revenue accounted for 45 percent.7%,Year-on-year growth of 22.3%。Excavating Machinery 180.800 million yuan,Year-on-year growth of 69%,Concrete Machinery 75.400 million yuan,Year-on-year growth of 6.1%,5.1 billion yuan for lifting machinery,Year-on-year growth of 24.6%,Piling Machinery and other products 58.500 million yuan,Year-on-year growth of 98.3%。Benefiting from the increase in overseas sales、Product mix improved,The interest rate of the company's overseas main business has steadily increased.,Gross profit margin increased from 24% in the first half of the year.42%,Up to 27 in the second half of the year.97%。Look at the area,Asia-Australia Region 148.500 million yuan,Growth 41.1%;European region 117.800 million yuan,Growth 44%;North America region 40.300 million yuan, Growth 85.8%;South America region 30.700 million yuan,Growth 63.8%;Africa region 28.500 million yuan,Growth 35.4%。

2022,XCMG Achieves Overseas Revenue 278.3.8 billion yuan,Year-on-year growth of 50.5%,Accounting for 29% of the company's total revenue.67%,Increase in export share 2.42 percentage points。Asia Pacific、Central Asia、African region、Americas region、European zone、West Asia and North Africa、Oceania region、Eight countries in South America grew by 60% respectively.2%、68.82%、35.97%、217.94%、195.11%、27.19%、19.10%、99.29%。Substantial growth of key products,Excavating Machinery、Zhongda loader、Wheeled crane、Mining Machinery、Road Machinery revenue increased by 48..56%、31.45%、74.05%、256.2%、24.87%。Continuous improvement of spare parts network,South Africa and other six spare parts centers completed construction,Completion of 23 spare parts outlets in 13 countries including NigeriaPMSSystem inventory networking。Brazil Manufacturing Full Year Revenue Growth of 86.35%。Schwing Germany revenue growth of more than 30 percent%。

Zoomlion's Overseas Revenue in 2022 99.9.2 billion yuan,Year-on-year growth of 72.6%,24%%。Indonesia、India、United Arab Emirates、Saudi Arabia、Turkey and other key countries have achieved remarkable results in their localization development strategies.,Sales performance increased by more than 100% year-on-year%。The export revenue of engineering hoisting machinery exceeds 3 billion yuan.,ZAT8000HBatch delivery of all-terrain crane,It is the largest tonnage all-terrain crane exported overseas by China.。AeriaL Work Machinery products are sold to more than 80 countries and regions overseas., Successfully enter the high-end market in Europe and America, Canada 、 Mexico 、Brazil、Poland and other countries achieve the first market share of Chinese brands。

Liugong achieved overseas revenue of 81.1.9 billion yuan,Year-on-year growth of 35.69%,30% of revenue.66%,Gross profit margin 24.38%,Year-on-year growth of 3.61%。Annual overseas sales of Excavators increased by 68%,Become the largest product line of international business sales。Bulldozer、Road Machinery、Sales of Mining Machinery have achieved substantial growth.,Liugong Earthmoving Machinery Product Portfolio Advantage Continues to Expand。

Zhejiang Strives to Achieve 33% Overseas Revenue in 2022.8.8 billion yuan,Year-on-year growth of 71.21%,Sales accounted for 64 percent.80%,Up 23% from 2021.19 percentage points。Among,The company's overseas sales revenue of arm products increased by 122..24%。

At present,The international environment is still complex and grim.,The Rise of Global Trade Protectionism,The game between big powers and the complexity of global politics and economy bring uncertainty to the overseas road of the industry.,Exchange rate、Global logistics and transportation、Commodity prices、Food security and so on have a strong impact.,Deep reconstruction of global industrial chain and supply chain,Industrial chain regionalization、The trend of localization is constantly strengthened.,Undoubtedly, it has brought great challenges to China's construction machinery overseas.。

Break the cycle with scientific and technological innovation

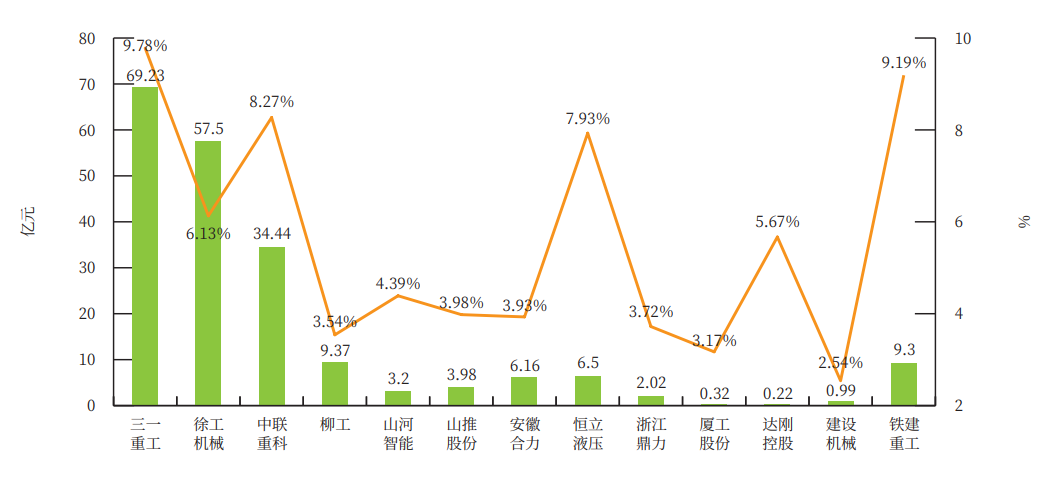

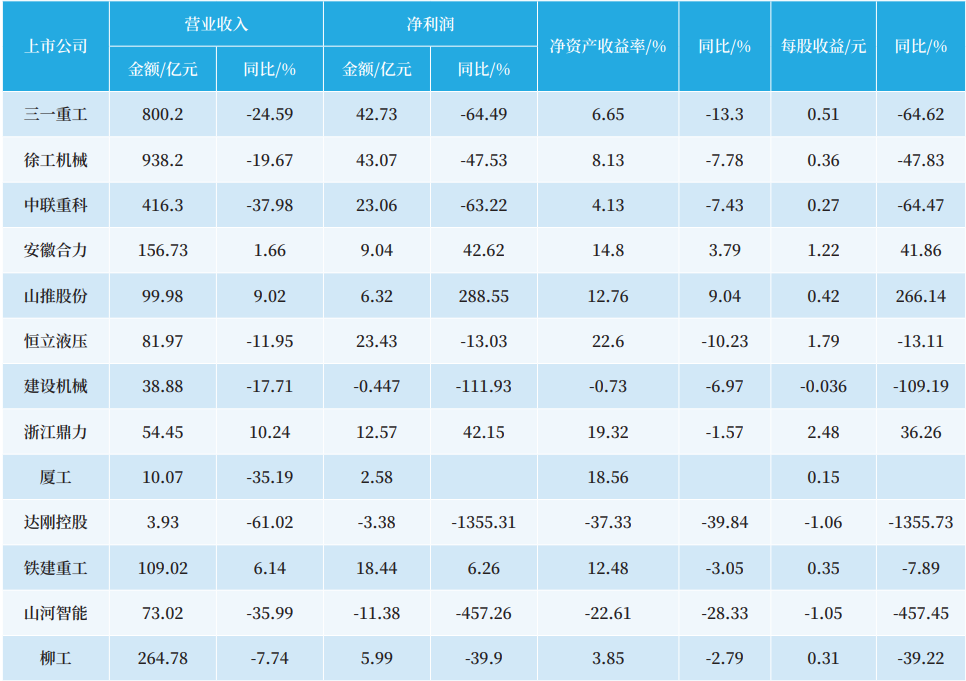

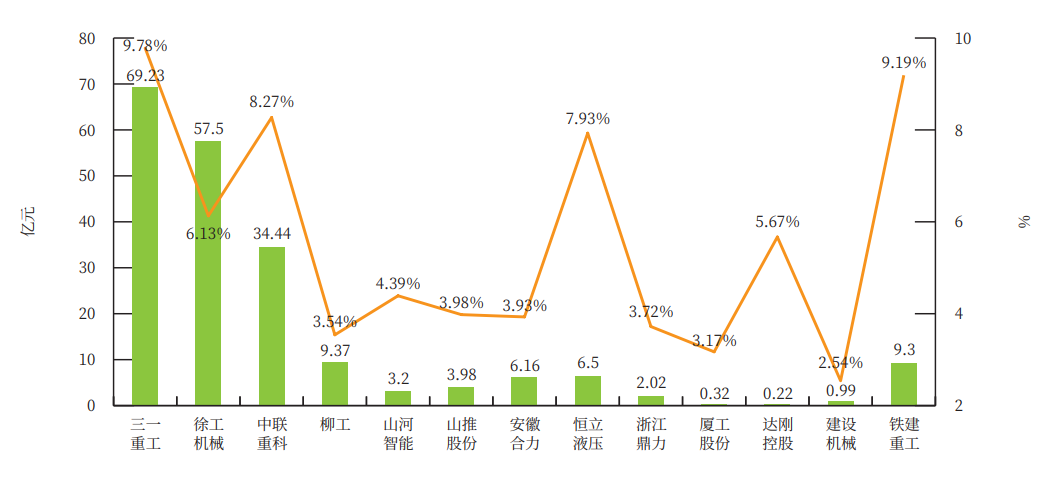

The essence of enterprise competition is talent competition.,Heavy warehouse talent is the future of heavy warehouse。2022,R & D investment of major listed companies in the industry(Illustrated in Figure 7)。Sany Heavy Industry R & D Investment 69.2.3 billion yuan,Year-on-year growth of 6.36%,Proportion to operating income 9.78%,Proportion of R & D personnel to the total number 28.31%。Zoomlion's R & D investment 34.4.4 billion yuan,Year-on-year decline of 18.58%,Accounting for 8% of operating income.27%,The proportion of R & D personnel in the total number is 29.71%。XCMG R & D investment 57.500 million yuan,Year-on-year growth of 1.49%,Accounting for 6% of operating income.13%,The proportion of R & D personnel in the total number is 21%。Sunward Intelligent R & D Investment 3.200 million yuan,Year-on-year decline of 20.79%,Proportion to operating income 4.39%,R & D personnel account for 15% of the total number.65%。Liugong R & D investment 9.3.7 billion yuan,Year-on-year increase of 0.29%,3% of operating income.54%,R & D personnel accounted for 31% of the total number.07%。Railway Construction Heavy Industry R & D Investment 9.300 million yuan,Year-on-year increase of 2.07%,Proportion to operating income 9.19%,Proportion of R & D personnel in the total number 30.49%。The above data fully shows that major enterprises are aware of,In the final analysis, enterprise competition is scientific and technological innovation.,Increase R & D and innovation,Is the enterprise to achieve higher speed in the future、The driving force for higher quality development。

Figure 7 R & D Investment of Major Listed Companies in 2022

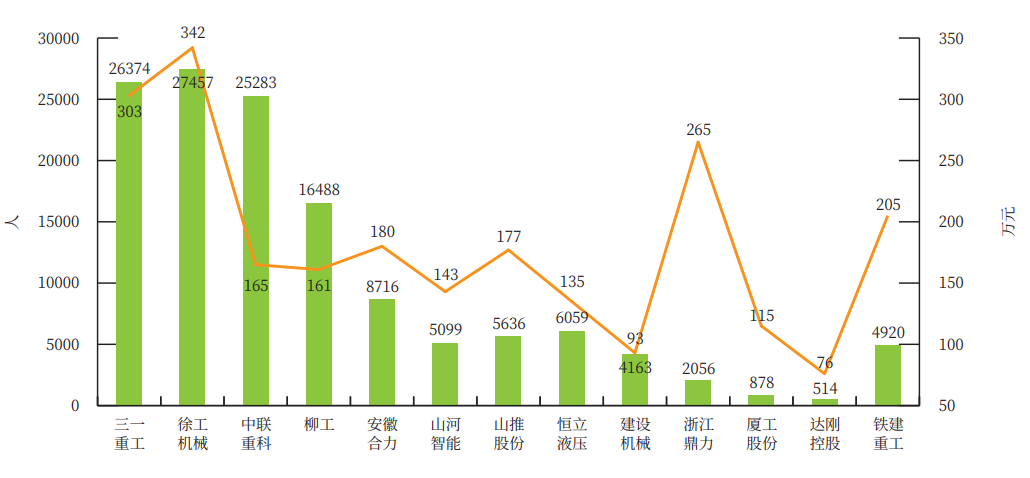

The total number of employees of 13 listed companies in 2022 is 128007.,Year-on-year growth of 11%,Operating income per capita is shown in Figure 8.。Among,XCMG's per capita revenue is 3.42 million yuan.,Sany Heavy Industry's per capita revenue is 3.03 million yuan.,The per capita revenue of Zoomlion is 1.65 million yuan.,Zhejiang Dingli's per capita revenue is 2.65 million yuan.,The per capita revenue of Railway Construction Heavy Industry is 2.05 million yuan.,Liugong's per capita revenue is 1.61 million yuan.,Anhui Heli's per capita revenue is 1.8 million yuan.,Shantui shares per capita revenue of 1.77 million yuan。With the major leading enterprises carrying out lighthouse projects and large-scale industrial Internet transformation.,R & D personnel of major enterprises have increased.,The number of industrial workers decreased.,It also reflects the digital transformation of enterprise intelligent manufacturing.,Not only can the manufacturing cost be greatly reduced,,More importantly, it can greatly improve the performance and quality of products.,Improve competitiveness。

Figure 8 Per Capita Revenue of Major Listed Companies in 2022

《The Caterpillar Way》It was pointed out in the book,Caterpillar regards R & D as the core power source of enterprise development,In adversity, we still insist on breaking through the dilemma through technological research and development.。It is believed that for Chinese construction machinery enterprises that have undergone several periodic adjustments,,Breaking the cycle with scientific and technological innovation has become a consensus.。

Although China's construction machinery industry is still in the downward cycle.,But in the medium and long term,,China's industrialization and urbanization have not yet been completed.,Still in the process of development,Plus the railway、Highway、Airport、 Urban Rail Transit、Water Conservancy、Increased investment in infrastructure such as underground pipe galleries,Superimpose the state to strengthen environmental governance、Increased demand for equipment renewal、Driving factors of artificial substitution effect,And the promotion of the global competitiveness of Chinese brands.,China's construction machinery still has a long-term broad market prospects.。At present,The fourth industrial revolution and the third energy revolution overlap.,The world is in an unprecedented window of super technology.,China's construction machinery ushered in a long-term technological rise cycle。With the strong rise of domestic brands.,The rising status of the global industry。It can be predicted,Chinese enterprises rely on the rapid improvement of product technology and service capabilities.,There are still many opportunities to write in the international arena.。