1.Import and Export of Construction Machinery in China

According to the data of the General Administration of Customs,2022 1-In November, China's import and export trade volume of construction machinery was 428.$4.2 billion,Year-on-year growth of 25.9%。Of which, the import amount is 25.$1.9 billion,Year-on-year decline of 26.7%;Export amount 403.$2.2 billion,Year-on-year growth of 31.8%,Trade surplus 378.$0.3 billion,Year-on-year increase of 106.$5.5 billion。

Imports in November 2022 2.$100 million,Year-on-year decline of 22.6%;Exports 38.$1.1 billion,Year-on-year growth of 13%,Shown in Table 1。On the import side,2022 1-November,Parts import 16.$5.2 billion,Year-on-year decline of 20.4%,65% of total import.6%。Imported complete machine 8.$6.7 billion,Year-on-year decline of 36.2%,65% of total import.6%,Imported complete machine 8.$6.7 billion,Year-on-year decline of 36.2%,Accounting for 34% of total import.4%。Among the main products imported,The import value of Excavator/ 'target='_blank' style='color:blue;'>Crawler Excavators decreased by 68.6%And 66.9%,The import volume decreased by 2..$2.7 billion;Imports of spare parts and components decreased by 4..$2.4 billion。The main products of the decline in import volume are:Crawler Excavator、Forklift and other engineering Vehicles,Paver、Crawler Cranes and high-powered Bulldozers.。The main products with increased import volume are::Rock drilling machines and pneumatic tools、Loader、Pile Drivers, engineering drilling rigs, road builders, Graders, etc.。

On the export side,Accumulative export of complete machine 265.$2.6 billion,Year-on-year growth of 35.4%,65% of total export.8%;Parts export 137.$9.6 billion,Year-on-year growth of 25.5%,Accounting for 34% of total export.2%。1-The main complete machines whose export volume increased in November were:Crawler Excavator、Forklift、Loader、Non-road mining dump Truck, etc.。Decreases in exports include:Crawler Cranes and other compacting machinery。

2022 1-In November, the export of construction machinery to six continents maintained varying degrees of growth.,Among them, 38 were exported to South America..$0.5 billion,9% of total export.44%,Year-on-year growth of 56.7%;Exports to North America 50.$8.4 billion,12% of total export.6%,Year-on-year growth of 36.7%;Exports Oceania 19.$6.3 billion,4% of total export.87%,Year-on-year growth of 36.7%;Export to Europe 94.$3.2 billion,Accounting for 23% of total export.39%,Year-on-year growth of 35.3%。The growth rate of export volume in the above regions is higher than that of total export volume.。Exports to Asia 164.$9.5 billion,40% of total export.9%,Year-on-year growth of 25.2%;Exports to Africa 35.$4.3 billion,8% of total export.79%,Year-on-year growth of 24.2%。Out of six continents,To Asia、African exports grew at a slower pace than total exports。

Distribution and change of main regional export markets,ASEAN, Africa and Latin America both account for 18.%Above,European Union and the United Kingdom、The United States accounts for 10 percent-15%Between,The main regional market with a larger increase was the Russian Federation, which grew by 61 percent.8%、Africa and Latin America up 39.1%And that United state 33.2%,Shown in Table 2。

Main export countries,To the United States、Russia、Indonesia、Japan、Australia、Brazil、Vietnam、India、Belgium、The top 11 countries and regions, such as Thailand and South Korea, all exported more than $1 billion in the first 11 months.,The export volume of the top 20 countries and regions accounted for 68% of the total export volume of China's construction machinery..94%。Including an increase of 109% for Saudi Arabia.5%、Indonesia grew by 76.9%、Brazil grew by 68.5%、Belgium 58.7%、Canada 57.7%、Netherlands 55.1%、South Africa 52.8%,The above increases are all more than 50 percent%。Shown in Table 3。

2022 1-November,Direction of construction machinery in China“The Belt and Road”Total exports from countries along the route 170.$6.8 billion,Accounting for 42% of total export.3%,Year-on-year growth of 31.7%;Exports to BRICS countries 65.$5.3 billion,Accounting for 16% of total exports.25%,Year-on-year growth of 55%。In the first 11 months, the main source countries of imports with an import volume of more than 100 million US dollars were Japan 5..$3.7 billion,Year-on-year decline of 36.5%、Germany 5.$3.6 billion,Year-on-year decline of 33.6%、Korea 2.$7.1 billion,Year-on-year decline of 48.4%、United States 1.$900 million,Year-on-year decline of 4.28%、Italy 1.$3.3 billion,Year-on-year decline of 23.5%、Sweden 1.$0.9 billion,Year-on-year decline of 13.6%。

Main characteristics of import and export of China's construction machinery products in 2022:

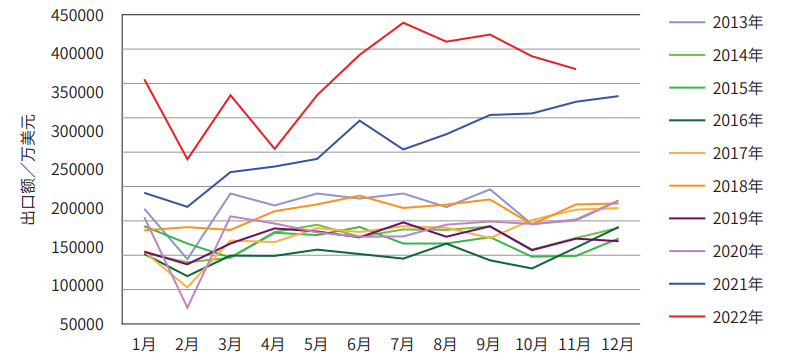

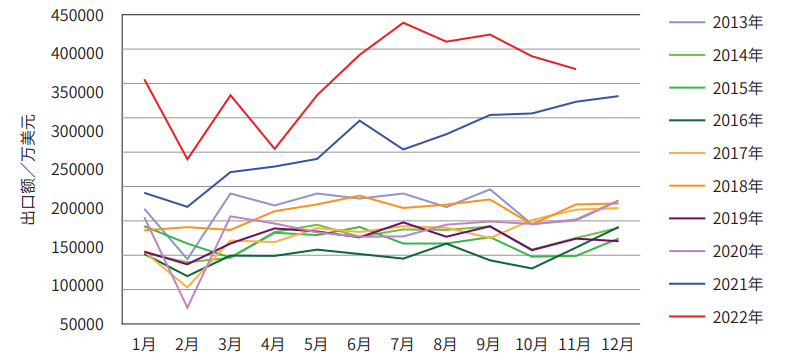

(1)China's Construction Machinery Exports Exceed US $40 Billion for the First Time。Exports in the first 11 months reached 403..$2.2 billion,Year-on-year growth of 31.8%,On track to reach or exceed $44 billion for the full year,An increase of about 10 billion US dollars over the annual export volume in 2021.。

(2)The export volume remained at a high level.,However, the rapid growth momentum of monthly export volume has slowed down.。In the first 11 months, China's export volume of construction machinery has maintained a relatively high level and growth rate.,Of which 7、8、Exports in September were all above $4 billion.,6、10、Exports in November were close to $4 billion.,Export growth in November continued the downward trend since the second half of the year.,To grow by only 13%。Shown in Table 4。

Table 4 2013-2022(1-November)Monthly Change of Export of China's Construction Machinery Industry

(3)Construction machinery imports hovering at a low level。Imports remained at a low level in the first 11 months.,9、Even less than $200 million in October,This has only happened in October 2015 and February 2016.,Even in October, it was the lowest monthly import volume in history.,Back above $200 million again in November,2.$100 million,The year-on-year decline was maintained at 22 percent.6%。

2.Export Situation of Major Domestic Construction Machinery Enterprises

Recovery of overseas market in 2021,The boom will continue in 2022。According to Off-Highway Research Statistics of, Sales of construction machinery in overseas regions increased significantly in 2021,The North American market grew by 22% year-on-year%,Western European market grew 19% year on year%,The Indian market grew by 10% year-on-year%,The Japanese market grew by 1% year-on-year%,Markets in other countries and regions grew by 24% year-on-year%。China's domestic construction machinery market sales fell sharply,But overseas has become another home to support domestic enterprises.。2022,The overseas market growth of major domestic construction machinery enterprises is bright.。

Sany Heavy Industry:2022 1-September,The company achieved international sales revenue of 258..800 million yuan,Year-on-year growth of 43.7%,10% faster than the first half.8 percentage points;Among,International sales revenue excluding Putzmeister 213.1.4 billion yuan,Growth 56.8%,16% faster than the first half.6 percentage points。Among,Achieve sales revenue in Asia-Australia region 115.9.5 billion yuan,Growth 52.3%;The European region achieved sales revenue of 75.1.7 billion yuan,Growth 26.5%;Sales revenue in the Americas region 48.4.6 billion yuan,Growth 63.5%;Sales revenue in the Africa region 19.200 million yuan,Growth 29%。Overseas sales of main products,Excavating Machinery 121.2.9 billion yuan,Year-on-year growth of 62.76%;Concrete Machinery 55.5.1 billion yuan,Year-on-year growth of 0.88%;Lifting machinery 36.7.2 billion yuan,Year-on-year growth of 14.26%;Piling Machinery and other products 45.2.8 billion yuan,Year-on-year growth of 146%。Rapid increase in global market share of excavation machinery,Overseas market share has exceeded 8%;In America、The UK、Italy、Brazil、Canada and other big countries in overseas excavation machinery market,Sales revenue achieved 60%The rapid growth of more than。

XCMG:According to the Zhongbao of XCMG,The company's export revenue 124.8.8 billion yuan,Year-on-year growth of 157.28%、The growth rate is higher than that of the industry。While reducing costs and increasing efficiency,The company continued to strengthen R & D investment.,Technical quality advantages are further highlighted。After more than 20 years of exploration and practice,,The company has taken a unique road of internationalization.,Export trade has been formed.、Overseas Greenbelt Factory、Cross-border mergers and acquisitions and global R & D“Four in one”International Development Model,It can provide all-round product marketing services for global customers.、Full value chain services and overall solutions。First half,XCMG achieves export doubling。Main products、Substantial growth in major regions,Self-operated exports increased by 157..28%,Export sales revenue accounted for 32% of business income.69%。

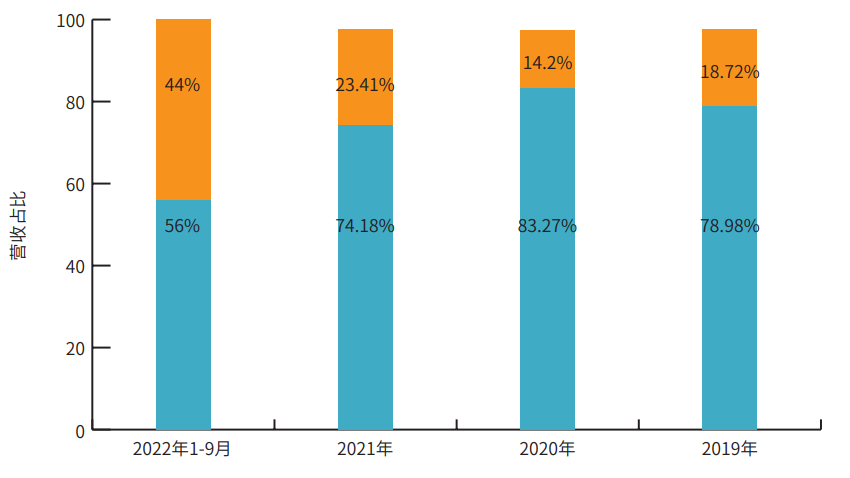

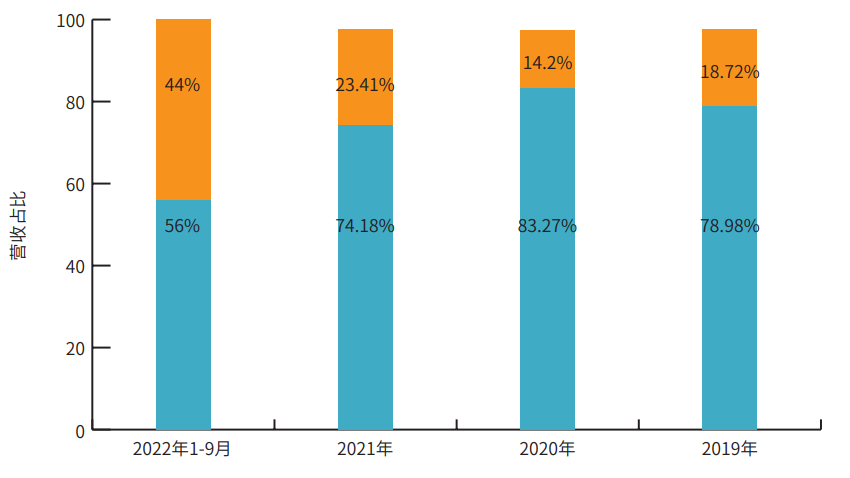

Zoomlion:Zhongbao shows,In the first half of 2022, the company achieved overseas revenue of 38..8.7 billion yuan,Year-on-year growth of 40.45%,The proportion of overseas income increased to 18.25%,Up 11% from the same period in 2021.71 percentage points。Opening factories overseas is an important measure for many construction machinery enterprises to implement the internationalization strategy.。Take Zoomlion as an example.,It has established more than 30 subsidiaries and 10 production bases around the world.。The company's R & D center、Production base、Market Network、The service system covers 125 countries and regions around the world.。

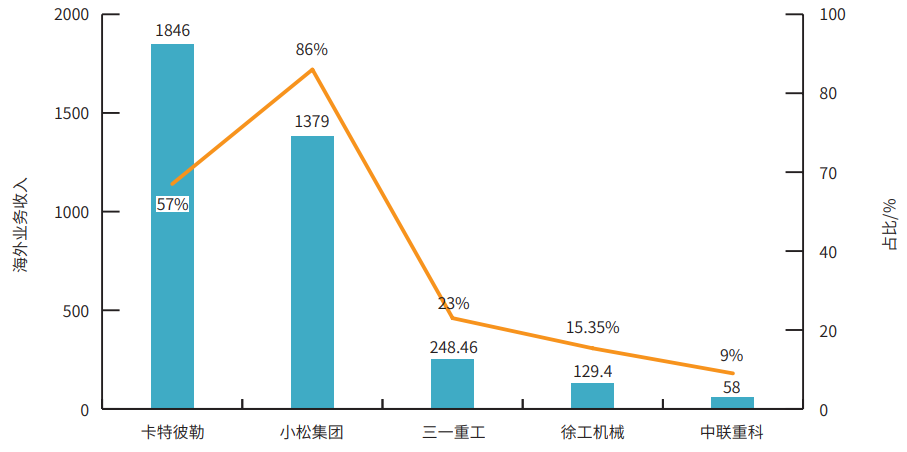

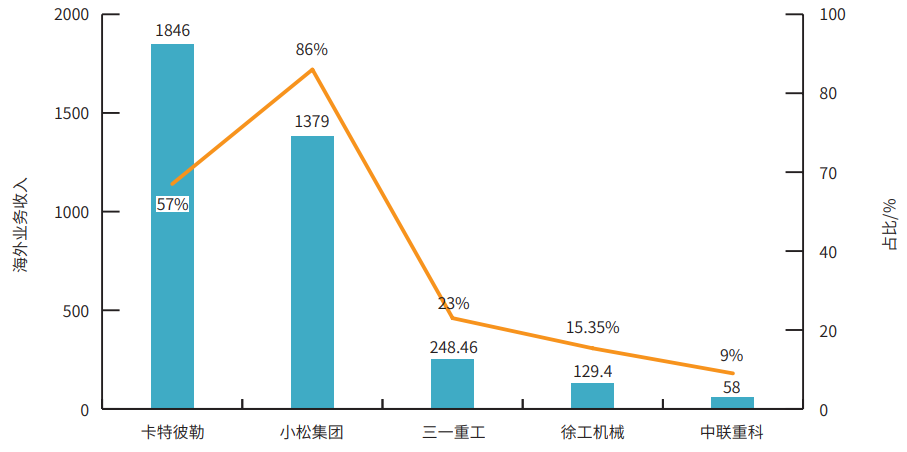

Internationalization of Major Domestic Construction Machinery Enterprises、Electric layout,Actively respond to cyclical fluctuations in the single market,Actively carry out localized management,Localized production base layout,Optimize costs;Introduction of new models adaptable to different markets;The number of overseas channels and service outlets has increased year by year.。2021,Sany Heavy Industry、XCMG、Zoomlion's overseas revenue was 248..4.6 billion yuan、129.400 million yuan、5.8 billion yuan,The proportion was 23..4%、15.35%、8.6%。The top three domestic enterprises and Caterpillar and other enterprises accounted for the overseas revenue in 2021, as shown in Figure 1.。Sany Heavy Industry 2019-The change of domestic and foreign business income in 2021 is shown in Figure 2.。

Figure 1 The proportion of overseas revenue of the top three enterprises and Caterpillar in 2021

Figure 2 Sany Heavy Industry 2019-Changes in domestic and foreign operating income in 2021

Why is the demand for overseas construction machinery strong??

According to the annual number of Excavator hours announced by Komatsu,,The whole year of 2022,The region with the longest cumulative operating time of Komatsu Excavators is Indonesia.,Total start-up time is 2372 hours.,Year-on-year increase of 98.3 hours,Growth 4.3%。The accumulative operating time of Komatsu Excavator in China is 1108.6 hours,Year-on-year decrease of 168.1 hour,Down 13.2%。Only in February, the number of construction hours increased compared with the same period in 2021.,Year-on-year growth of 6.7%,The rest of the months have decreased.,The largest decline was in January.,35.9%。December 2022,China Komatsu Excavator operating hours of 94.3 hours,On a month-on-month basis, it fell 3%,Year-on-year decline of 13.8%,Decline year-on-year for 10 consecutive months。September Komatsu Japan、 Europe、The operating hours of Excavators in North America and Indonesia were 48.4、76.1、73.5 and 208.9,The year-on-year growth rate was-4.5%、-7.8%、 +4.9%And+7.2%。Since the second half of last year,North America、The operating hours of Excavators in Indonesia and other places in Southeast Asia maintained a positive growth as a whole.,Achieve a better growth rate,The number of start-up hours in the European market has shown a downward trend in the past four months.,The Japanese market is relatively depressed.。Indonesia's better market prosperity will enhance the certainty of China's construction machinery exports to maintain the current high level.。

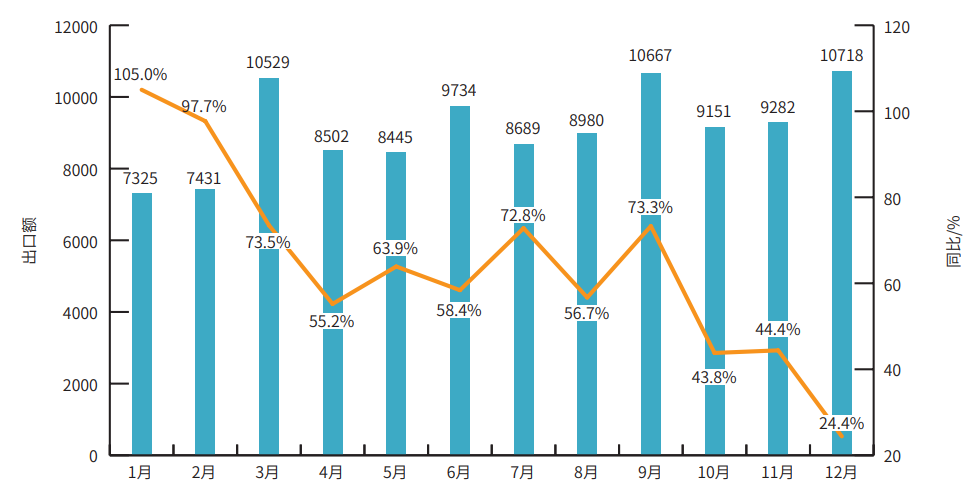

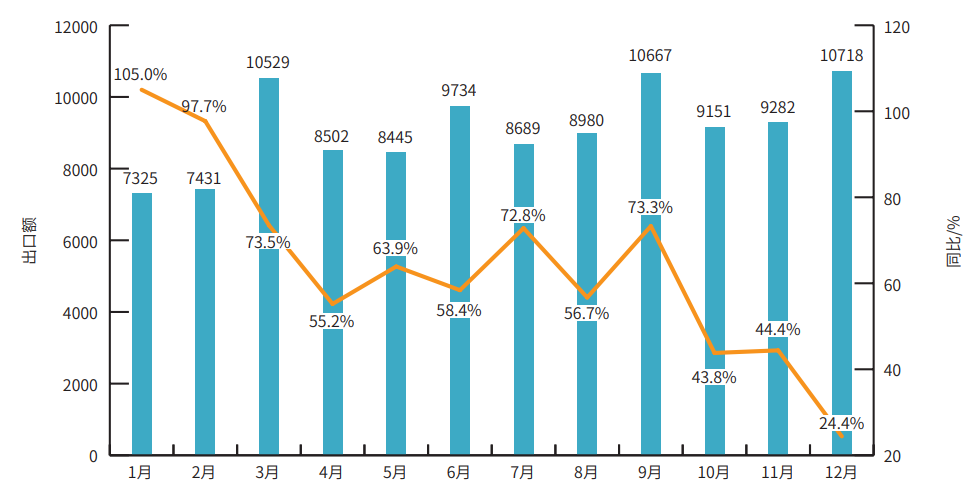

According to the relevant information,,The global recession may mean that metal prices will fall slightly in 2023.,But commodity markets are expected to be more stable.。Due to the adoption of renewable energy and related technologies,The metals and minerals market is expected to grow steadily over the next decade,Demand will continue to increase.。The impact of the epidemic on the mining industry is fading.,Mining activity is expected to pick up in several regions of the world over the next decade.。It is expected that by 2030,The surface mining market will be worth $39.7 billion.,The compound annual growth rate is about 3.20%。The continuous growth of mining will provide important support for Excavators and other products in China.。The monthly export of Excavators in 2022 is shown in Figure 3.。

Figure 3 Monthly export of Excavators in 2022

Lu Ying, deputy secretary general of China Construction Machinery Industry Association, pointed out.,Affected by the epidemic in 2022,Machinery manufacturers in Europe and the United States are facing severe challenges.。The early stage mainly comes from the sharp rise in the cost of raw materials and the shortage of spare parts.,It is more difficult for the European and American machinery manufacturing industry chain to ensure normal shipment.,The delivery cycle is extended,The speed of supply has slowed down,Market competitiveness is declining。Affected by geopolitical conflicts,This is exacerbated by high energy prices and a higher dollar index.。China's rational layout、Abundant production capacity and competitive prices,China's machinery manufacturing exports continued to grow at a high speed.。Steel is an important upstream industry of machinery manufacturing.,China's steel supply and price advantage,It also provides a unique advantage for the machinery manufacturing industry.。

Two consecutive years of decline in the domestic construction machinery market,The rapid growth of overseas exports has become a strong support for domestic construction machinery enterprises.,It also confirms from the side that the steady and steady business strategy of Chinese construction machinery enterprises in the overseas market for many years has finally achieved a harvest.。“Take me as the main body、Local operation、Service first”,Overseas market channels and brand building、Service capacity building has been promoted simultaneously.,Positive progress has been made in international operations,The ability of enterprises to participate in global competition is increasing.。This point from successive years in the UK.KHLThe top 50 global construction machinery released by the publishing group has also been fully proved.,In the 2022 list,Sales of Chinese construction machinery enterprises accounted for 24.2%,It is the country with the highest proportion。Big waves wash the sand,Every periodic adjustment,It is a kind of training for China's construction machinery enterprises.,“Blow out the yellow sand and pick up the gold”,Wish our country's construction machinery enterprises continue to develop and grow in the fierce global competition.。

【ChinaRoad MachineryNet original article,Please indicate the source for reprinting.】