Liugong: 2023 Annual Net Profit Expected to Increase by 35% -60%

January 26, 2024

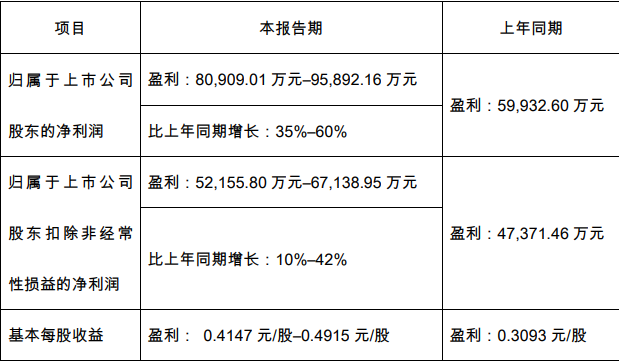

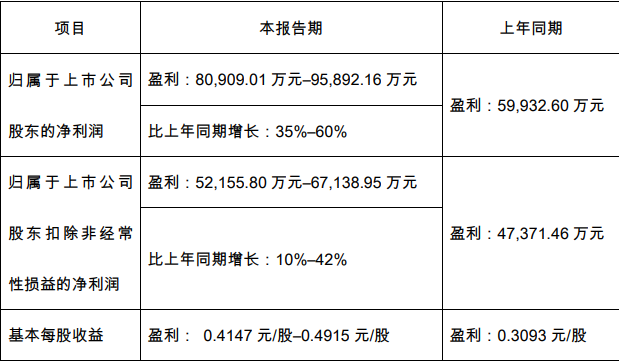

Engineer Liu(000528.SZ)Announce the 2023 Annual Performance Forecast,Net profit attributable to shareholders of the listed company during the reporting period,909.0.01 million yuan–95,892.160,000 yuan,Up 35% over the same period last year%–60%;Net profit attributable to shareholders of the listed company after deduction of non-recurring profit and loss Profit 52,155.800,000 yuan–67,138.950,000 yuan,Up 10% over the same period last year%–42%;Basic earnings per share Earnings 0..4147 yuan/Shares–0.4915 yuan/Shares。

According to the announcement,The main reasons for the expected increase in Liugong's performance in the current period are as follows::

1、During the reporting period,Although the demand of domestic earthwork machinery industry has dropped sharply for the second consecutive year.,After the completion of the overall listing last year, the company continued to deepen a series of institutional and internal operational reforms.,Around“Profit growth、Business growth、Ability growth”Three core tasks,Push forward with all your strength“A comprehensive solution、Fully intelligent、Full internationalization”Etc“Sanquan”Strategic landing,Domestic business revenue declined slightly.,Overseas business has achieved greater growth.,The company's overall main business income grew steadily.,Increase income and reduce expenditure in the whole industry chain,Promote cost reduction、The effect of increasing profits in all directions appears.,The company's comprehensive gross profit margin increased.,Ensure the steady growth of the company's performance;

2、The achievements of the 21st anniversary internationalization strategy of the company are highlighted.,International business maintained steady development in 2023,The international business of more than 30 product lines has achieved rapid growth.,The growth rate outperformed the industry by nearly 20 percentage points,International business revenue exceeded 10 billion yuan for the first time,Year-on-year growth of more than 30%;

3、During the reporting period,The company's aerial work Vehicle、Vehicles/ 'target='_blank' style='color:blue;'>Industrial Vehicles、Prestress、Post-market and other weak cycles、Accelerated development of new strategic business,Performance contribution is increasing rapidly.;

4、The company has always strictly followed the accounting policy.,During the reporting period, the Company made a relatively strong provision for impairment of problematic and risky assets.,Although it has a greater negative impact on the company's performance.,But it ensures the soundness of the company's financial statements.;

5、During the reporting period,The company expects that the impact of non-recurring gains and losses on net profit will increase significantly year on year.,This is mainly due to the sale of its main productive assets by Liugong Ruista Machinery Co., Ltd., a wholly-owned subsidiary.。