Shantui Shares: It is estimated that the attributable net profit from January to June will be 378 million yuan to 453 million yuan.

July 16, 2024

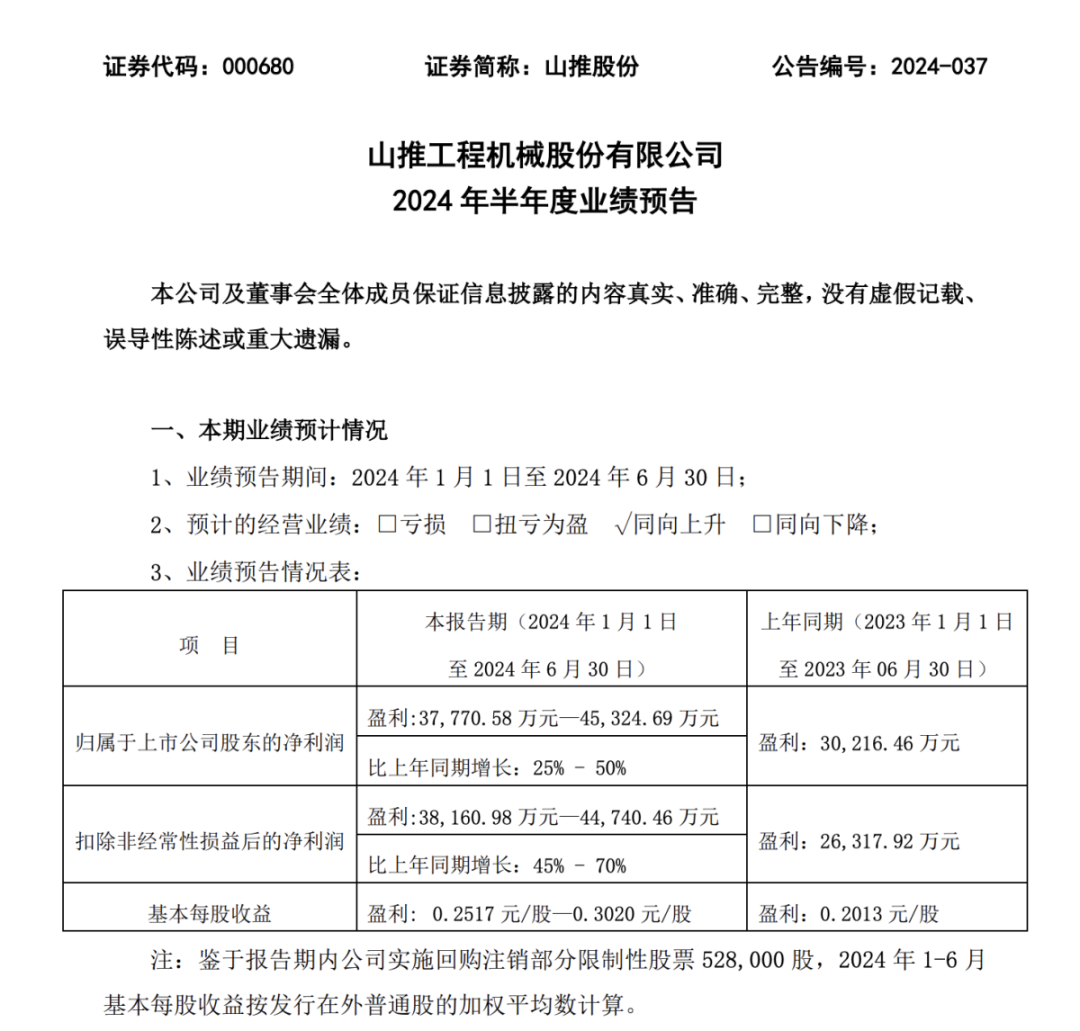

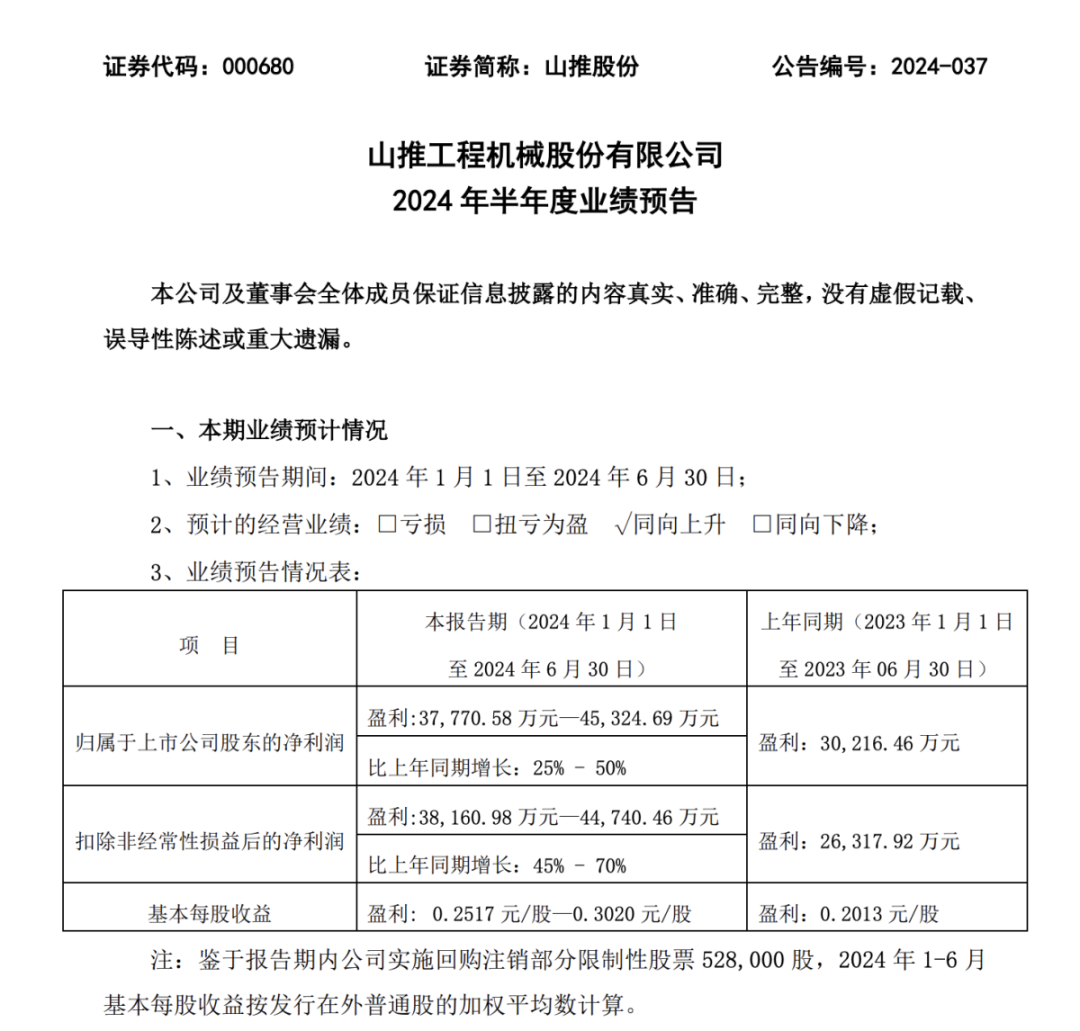

According to Shantui shares issued a performance forecast.,Projected 2024 1-Attributable net profit in June 3.7.8 billion yuan to 4.5.3 billion yuan。

Screenshot of Shantui 2024 First Half Financial Forecast

The announcement explained the reasons for this performance change as follows::The main reasons for the year-on-year increase in net profit attributable to shareholders of listed companies in the first half of 2024 are as follows::First, the company actively explore the market.,The scale of income increased,In particular, overseas revenue increased significantly compared with the same period last year.;Second, the company increased efforts to reduce costs and control costs.,Further improvement of profitability。

The first quarterly report of Shantui shares in 2024 shows,Company's main business income 30.6.9 billion yuan,Year-on-year increase of 29.39%;Net profit attributable to parent company 2.0.8 billion yuan,Year-on-year increase of 22.81%;Deducting non-net profit 2.0.9 billion yuan,Year-on-year increase of 44.92%;Debt ratio 57.27%,Investment income 522.430,000 yuan,Financial expenses -5.0.05 million yuan,Gross profit margin 17.05%。