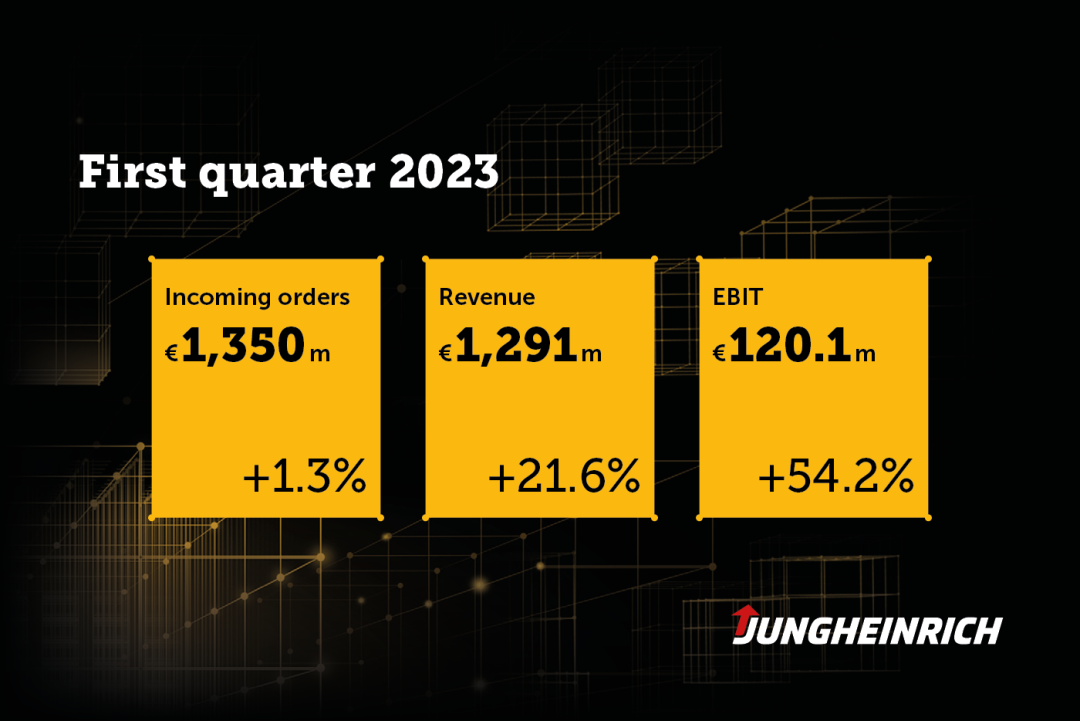

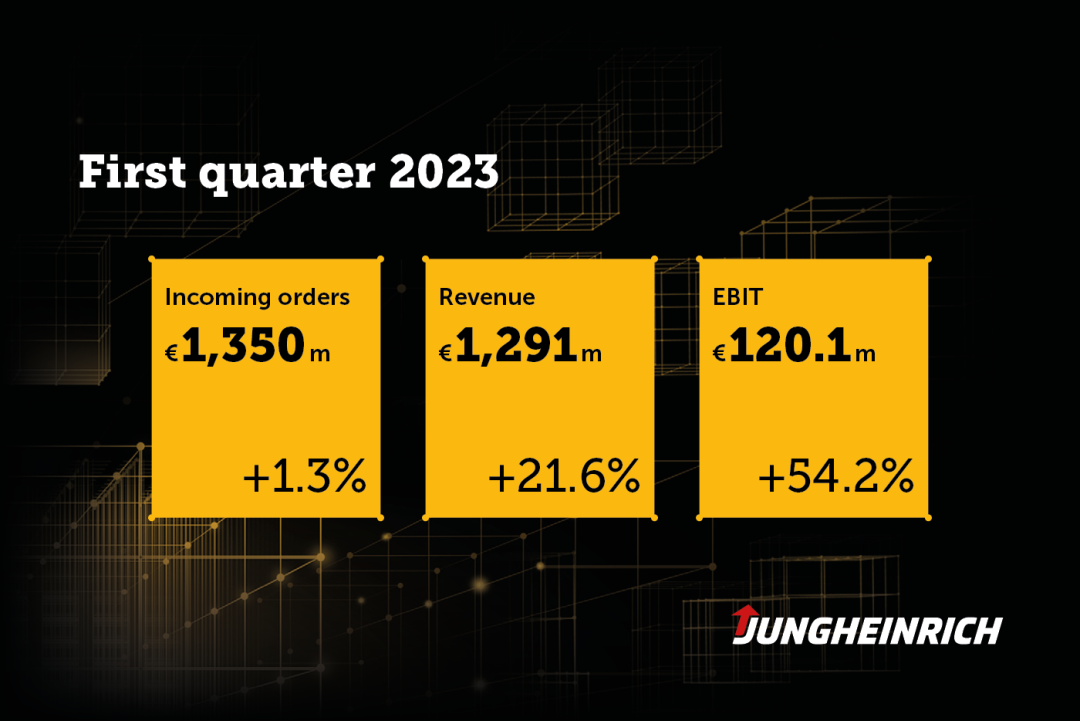

• Order amount:13.500 million euros (+1%)

• Operating income:12.9.1 billion euros (+22 %)

• EBIT:1.€ 20.1 billion (+54 %)

• EBIT margin:9.3 %

• The forecast for 2023 was raised

Hamburg, Germany,May 8, 2023——Jungheinrich's 2023 fiscal year started well。The first three months of this year,All business areas(New car business、Short-term rental and second-hand equipment and after-sales service)Total of new orders for is 13.500 million euros,Compared with the same period last year(13.3.3 billion euros)A slight rise)。As of the end of the reporting quarter,Orders in hand for new car business reached 17.7.9 billion euros,AmongStorage SolutionsThe group's order in hand is 1.3.6 billion euros。Compared with 15 at the end of 2022.€ 9.5bn compared to orders in hand,Increased by 1.€ 8.4bn or 12%。Group sales in the first quarter reached 12..9.1 billion euros,Compared with the same period last year(10.6.2 billion euros)Comparatively strong growth 22%。The main driver here is the new car business.。First three months of 2023,EBIT (EBIT) Up to a record 1..€ 20.1 billion。Compared to the previous year(€ 77.9 million)An increase of 54%。Proceeds have been acquired.Storage SolutionsTaking into account the EUR 9 million impact of the Group,This is mainly due to non-recurring transaction related costs.。EBITReturn on sales (EBIT-ROS) Reaching 9.3%(7 in the previous year.3%)。

Chairman of the Board of Directors of Jungheinrich GroupLars BrzoskaThe doctor explained:

“

“

Thanks to the dedication of the global team,We got off to a flying start in the new fiscal year.。Although the market environment is still challenging,But we are confident about the remaining three quarters of this year.。

”

Profit before tax for the first quarter of 2023 (EBT) Is 1.19.5 billion euros,A significant increase over the same period(Previous year:€ 66.9 million)。EBTReturn on sales (EBT-ROS) 9.3%(Previous year:6.3%)。The after-tax income was 88.4 million euros.(Previous year:49.5 million euros)。So,Earnings per preferred share were 0..88 euros(Previous year:0.49 euros)。

Free cash flow is –2.3.2 billion euros(Previous year:–1.8.6 billion euros)。AcquisitionStorage Solutions Paid 3.€ 5.2bn purchase price,Produced 3.€100 million free cash flow expense。Part of the purchase price is used to repay bank liabilities.,Therefore, it is not included in free cash flow.。If there is no acquisition,Operating the business will generate positive free cash flow。

Forecast Forecast

Based on the Group's good performance in the first quarter of 2023,The board of directors of Jungheinrich Group raised its forecast for the whole year of 2023 in an interim announcement on April 24, 2023.。Upgraded forecasts have been made for the acquisition of the United States on March 15, 2023. Storage Solutions GroupTake into account the impact of。

Jungheinrich now expects new orders for the full year 2023 to total between 5 billion and 5.4 billion euros.(Before:€ 4.8 billion to € 5.2 billion)。Group sales are expected to be between 5.1 billion euros and 5.5 billion euros.(Before:€ 4.9 billion to € 5.3 billion)。The new forecast has beenStorage SolutionsGroup new orders of EUR 300 million and sales of EUR 200 million are taken into account。According to current estimates,,Earnings before interest and tax in 2023 will be between 400 million euros and 4 million euros..Between 500 million euros(Before:3.€500 million to €400 million)。As expected.,Storage SolutionsThe settlement of the acquisition will have a one-off impact on Group EBIT.,But these effects will be partiallyStorage SolutionsOffset by the Group's pro-rata share of operating profit。The increased EBIT forecast resulted in an EBIT margin of 7..8% To 8.6% Between(Before:7.3% To 8.1%)。

EBT It is expected to reach 3.700 million euros to 4.200 million euros(Before:3.€ 2.5 billion to €3.7.5 billion euros),Resulting from this EBT The rate of return is 7.2% To 8.0% Between(Before:6.6% To 7.4%)。We expect ROCE The data is between 15% And 18% Between(Before:Between 13% And 16% Between)。

In addition,Jungheinrich expects free cash flow to improve significantly year-over-year.(–2.3.9 billion euros),But because of the acquisition Storage SolutionsWhile remaining negative。The free cash flow forecast is the total purchase price to be paid in March 2023(3.5.2 billion euros)3 in.€100 million taken into account。Part of the purchase price is used to repay bank liabilities.,Therefore, it is not included in free cash flow.。